Table Of Content

You can also get prequalified if you want a quick estimate of your home buying budget. But getting prequalified won’t give you the power to make an offer on a house like a pre approval will. In this section, we’ll address frequently asked questions about when and how to obtain mortgage preapproval to guide you through this crucial step in the home buying process. This type of mortgage is based on the income you report to the lender without formal verification.

The difference between mortgage preapproval and prequalification

Mortgage Prequalification Calculator – Forbes Advisor - Forbes

Mortgage Prequalification Calculator – Forbes Advisor.

Posted: Mon, 21 Aug 2023 07:00:00 GMT [source]

If you’re applying with a spouse or other co-borrower whose income you need to qualify for the mortgage, both applicants will need to list financial and employment information. All of this makes a pre-approval much more valuable than a pre-qualification. It means that the lender has checked your credit and verified the documentation to approve a specific loan amount.

Home Loan Preapproval Vs. Approval

From preapproval to finalizing your loan, each stage requires careful preparation and informed decision-making. For an effective exploration of mortgage options, it is recommended that buyers approach at least three to four lenders. This balanced approach ensures a thorough market assessment without overwhelming the decision-making process, empowering buyers to choose the most advantageous preapproval tailored to their specific needs. Most lenders require a FICO Score of 620 or higher to approve a conventional loan, and some even require that score for a Federal Housing Administration (FHA) loan. Lenders typically reserve the lowest interest rates for customers with a credit score of 760 or higher.

Know the factors lenders use to preapprove you for a mortgage

Getting preapproved means your lender is willing, in principle, to lend to you up to a certain amount of money. But after signing a home purchase agreement, you’ll need to complete a full application for a mortgage on the property you’re buying. If you’re wondering how to get approved for a home loan, it’s important to understand the steps involved in the mortgage process.

What is mortgage preapproval?

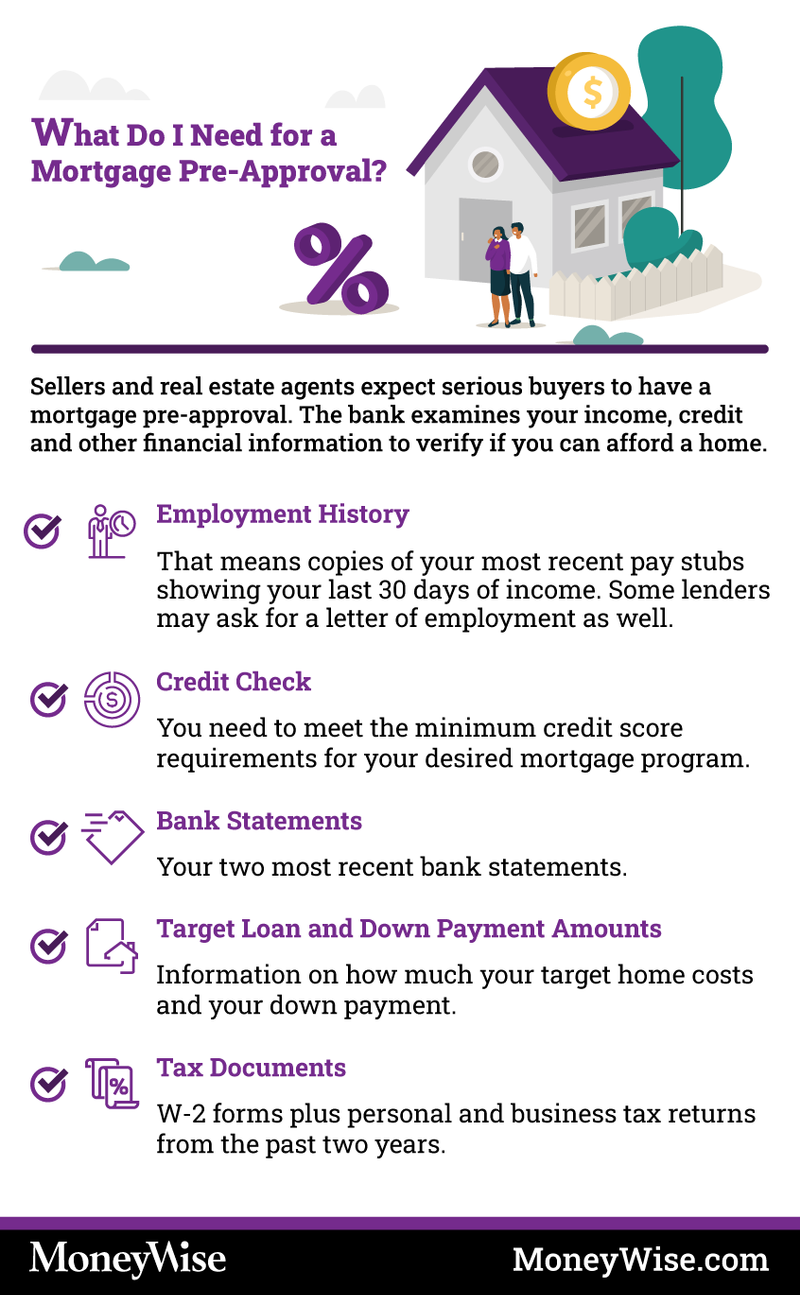

As such, they set an expiration date to encourage borrowers to complete their home search and proceed with a mortgage application in a timely manner. Lenders will have to view bank statements when it comes time to purchase a home, and large deposits will need to be sourced. Submit your tax returns because, when qualifying for a home loan, lenders oftentimes will need to review the past two years of income and tax liabilities. When you're planning to buy a home, one of the crucial steps in the process is getting pre-approved for a mortgage. Mortgage pre-approval is a process in which a mortgage lender evaluates your financial information and determines the amount of money they are willing to lend you for purchasing a home. This pre-approval helps you understand your budget, streamline the home-buying process, and strengthen your position as a serious buyer.

Will getting preapproved by multiple lenders hurt my credit score?

A preapproval will also require a hard credit check so your lender can see your credit score and other debt. Getting preapproved for a mortgage is a crucial step in the home buying journey. It’s like the green light from a lender, showing you the amount you can qualify for before diving into the formal mortgage application process. This initial nod not only gives you a clear picture of your budget but also amps up your ability to navigate the real estate market.

Mortgage Rates by State

Also, you’ll need an accounting of your monthly combined housing expenses, including rent or mortgage payments, homeowners and mortgage insurance, property taxes, and homeowners association dues. Seeking pre-approval six months to one year before a serious home search puts you in a stronger position to improve your overall credit profile. You’ll also have more time to save money for a down payment and closing costs. By contrast, a soft credit check occurs when you pull your credit yourself or when a credit card company or lender pre-approves you for an offer without your asking.

This aspect is a small but important part of how to get approved for a home loan. LMB Mortgage Services, Inc., (dba Quicken Loans), is not acting as a lender or broker. The information provided by you to Quicken Loans is not an application for a mortgage loan, nor is it used to pre-qualify you with any lender. This loan may not be available for all credit types, and not all service providers in the Quicken Loans network offer this or other products with interest-only options. The information that we provide is from companies which Quicken Loans and its partners may receive compensation.

Pre-approval holds more weight and is a stronger indication of your eligibility for a mortgage. If you’ve served or are currently serving in the military, you may be eligible for a VA loan, which is backed by the U.S. You may need to pay a funding fee, however, if you’re not exempt due to a service-related disability.

The faster you send them in, the sooner your mortgage can be approved. Self-employed people should be prepared to provide a list of their recent clients and any other sources of cash flow, such as income-producing investments. The bank may also want a copy of Internal Revenue Service (IRS) Form 4506 or 8821. You’ll also need to list all liabilities, which include revolving charge accounts, alimony, child support, car loans, student loans, and any other outstanding debts. Securities products and services are offered through Ally Invest Securities LLC, member FINRA / SIPC . Advisory services offered through Ally Invest Advisors Inc., a registered investment adviser.

If you're unable to obtain pre-approval, consult with your lender to understand the reasons behind the decision. Improve your credit score, address any outstanding debts, or consider alternative financing options. The necessary paperwork and verification have already been completed during pre-approval, allowing you to move forward with the mortgage application more efficiently. This speed can help you secure a property before other potential buyers who have not yet obtained pre-approval. When it comes to collecting important documents for mortgage pre-approval, it's essential to provide the lender with a comprehensive view of your financial situation.

And, for almost everyone, it’s just more fun to admire and tour homes currently on the market. After you find the right home and make an accepted offer, it’s time to officially apply for a mortgage. Even with preapproval, the process may take several weeks, as the lender thoroughly checks you out and the home as well, conducting an appraisal to determine its fair market value. As previously mentioned, the lender will also conduct a hard pull on your credit. The lower your credit utilization ratio is, the better your chances of getting preapproved for a mortgage.

No comments:

Post a Comment